Second Installment 2020 tax bills arrive across Cook County ... Implied "Covid-19 adjustment" relief nonexistent, as we predicted last May ... Bills due Oct. 1

August 27, 2021 10 mins

Owners all over Cook County this week received their second installment 2020 property tax bills.

The delivery of these bills has been much anticipated. With the Covid-19 pandemic, the flurry of government policy reactions, turbulence in financial markets, and a somewhat surprisingly hot real estate outlook later in the year, 2020 was a big question mark to many, in terms of property tax outlook.

As summer 2021 bore on, many began to wonder more keenly: How might all this impact my 2020 property tax total?

Well, the big reveal is here.

And the calls have been coming in fast and hard. If we at Property Tax Solutions had not already known the bills were out, clients would have made us aware in short order.

In general the overwhelming reaction has been shock over how much difference a few tweaks to the multipliers going into your tax bill can produce. This means, of course, our 2020 savings projections and invoices undershot the amount we saved our clients ... it was more in 90%-plus of cases. However, it also meant 2020 property tax bills were higher than expected.

Suffice it to say, our analysts at Property Tax Solutions were not surprised. In fact, we predicted exactly this would happen last May on this blog.

Early in 2020, the Cook County Assessor's Office announced it would essentially reassess the whole County in 2020 in response to Covid-19. Meaning, it would not only reassess the Townships up for Triennial Reassessment in 2020—those in the South and West suburbs—but the City and Northern Townships as well.

In the South and West, the Covid-19 adjustment boiled down to more moderate increase to proposed property reassessment values (some even went down compared to those of the prior three years). In the City and the North, everyone saw a more or less locally uniform property tax assessment cut that typically ranged between 6 and 10 percent.

This policy was announced with a fair measure of altruistic fanfare and a strong indication from the Assessor's Office that property owners would see a commensurate property tax reduction as a result of their Covid-19 adjustment. (Including from Assessor Fritz Kaegi himself, who said, "Property owners should know we’re taking these circumstances into account. It’s the right thing to do.")

We can write here with certainty that many property owners forewent tax assessment appeals in 2020 as a result of the Covid-19 adjustment policy and the way it was presented. Based on feedback from those we heard from, all had some variation of the same feeling: "I don't need to appeal this year, because the Assessor's Office is reducing my taxes."

Our analysts and Attorney and CPA Gregory Hilton, on the other hand, were always skeptical of the "Covid-19 adjustment" policy.

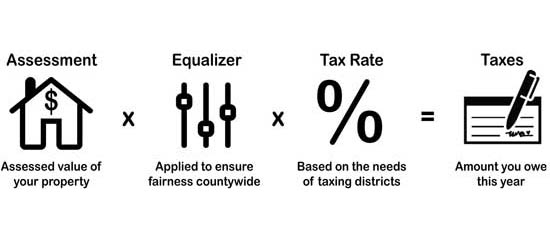

Our primary position was that it wouldn't save any property tax for the vast majority of Cook County owners. Facing the same budget obligations, a largely uniform assessment reduction can do nothing more than necessitate an increase of one or both the the two multipliers your assessment is put through to calculate your property tax liability.

To make a long story short, this prediction proved 100% correct. Our staff has performed literally hundreds of 2020 property tax re-calculations now that the new multipliers are out and have yet to find a single person who paid less on their property taxes thanks to the Covid-19 adjustment. It was entirely swallowed—and then some—by tweaks to the multipliers.

That's what we got right. Where we were wrong is the mechanism that would be used. We thought local tax rates would see a dramatic increase. In the final analysis, we saw only modest changes to tax rates. In reasssessment Townships, rates went down slightly; in non-reassessment Townships, rates went up slightly.

A typical year, as rates are concerned.

Where we saw the big, nearly unprecedented increase which not only cannibalized the entire Covid-19 adjustment but went in for a chunk more from Cook County property owners was in the Cook County Equalization Factor.

We will shortly follow up with another blog about the Equalization Factor—what it is, why it is, and the history of its movement—but, for now, if you are a looking at a bigger 2020 tax bill than you anticipated, the increase to the Equalization Factor is why.

The whole saga reads like a cautionary tale. While we do believe the changes were well-intended, it did not require any profound gift of foresight to read this outcome in the proverbial tea leaves.

What makes it ugly is that Cook County has well-known and reported issues with fair and uniform taxation. Tax rates are highest in the areas where residents can least afford it.

A different Covid-19 adjustment policy could have addressed this. It could have frozen assessments in our most financially strapped suburbs and increased them where property values were going up by leaps and bounds.

Instead, many of the County's poorest suburbs saw 2020 reassessment increases while Chicago and the North saw "Covid-19 adjustment" assessment decreases, despite the fact that property selling prices went through the roof.

And now every property owner has to make do with a huge Equalization Factor increase. Nobody has ever said reforming a system was easy.

These Second Installment 2020 property tax bills are due Oct. 1.