A Winning Appeal

Your property’s assessed value was just reduced, but what does that really mean?

The bottom line: Your taxes will be less than they would have been without an appeal for that year. Valuations generally remain in effect until your property’s next Triennial Reassessment or after another winning appeal.

$47,166 Savings est. over 1 year

Due to Property Tax Solutions’ appeal

An assessed valuation is equal to 10% of the Cook County Assessor’s estimated market value for a residential property and 25% of a commercial or industrial property. The Assessor’s valuation is the basis for calculating your property taxes. As opposed to when you’re selling property and want the highest price, your goal in an appeal is to reduce a property’s valuation by the maximum amount allowable by law.

If your mortgage lender pays your property taxes from an escrow account, alert them of a successful appeal by sending copies of the

County’s official notification letter(s) and our invoice. You should also request an automatic audit to reduce your monthly payment. If the reduction has not yet gone into effect by the time your second installment

tax bill arrives, send your lender a copy of this, and again request an audit.

$3,376 Savings est. over 1 year

Due to Property Tax Solutions’ appeal

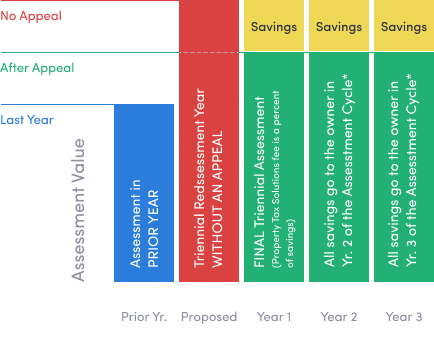

A Winning Appeal in A Triennial Reassessment Year

Check the chart below to view how your tax savings during a Triennial Reassessment year compare before and after an appeal.

During a Triennial Reassessment year, your savings is the difference between your

actual tax bill after an appeal and what that bill would have been had you not appealed.

The savings is not the difference from your prior year’s tax bill. Taxes nearly always increase in a

reassessment year when sale prices in a neighborhood increase.

Your property’s new assessed value then becomes the basis for comparison.

* Every three years, the Assessor’s Office updates property values to reflect the estimated market value. A lower assessed value during a Triennial Reassessment will nearly always remain in effect for three full years, but Property Tax Solutions’ fee is for only a portion the first-year’s savings.

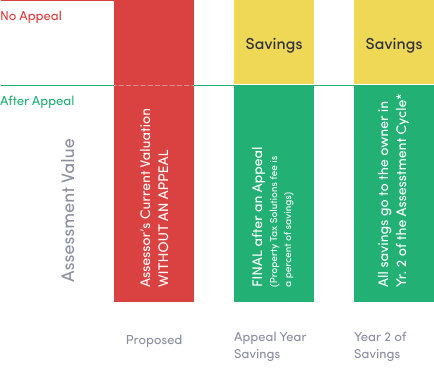

A Winning Appeal in A Non-Triennial Reassessment Year

Winning appeals in Year 2 of the Reassessment Cycle will nearly always result in two years of tax savings. If you miss a Year 2 appeal deadline, you may be asking, “Should I skip Year 3 and wait to appeal at the next Triennial Reassessment?” Our advice: Don’t wait. If a Year 3 appeal would reduce your taxes by $800, you would still have $400 more than had you not appealed, even after paying our Property Tax Solutions fee. Property owners have the right to appeal at both the Assessor and at the Board of Review once a year. There is no risk. Your tax base will either remain the same or, ideally, be lower. Because reductions from both appeals are cumulative, your tax savings will also be greater. We invite you to register with us below.

Calculating Your Savings From A Successful Appeal

The Tax Calculator on your Second Installment Property Tax Bill, due August 1 of each year, is virtually the same format used to calculate savings from a winning appeal. The only exception is that two columns are necessary to compare taxes before an appeal and after an appeal.

| Before Appeal |

After Appeal |

| Accessed Valuation |

| |

|

| X - State Equalization Factor (2018)* |

| 2.9109 |

2.9109 |

| Equalized Assessed Value |

| |

|

| X - Your Local Tax Rate |

| % |

% |

| Tax Bill (before exemptions) |

| |

|

| Savings |

| (Before less After) |

$ |

| |

Before Appeal |

After Appeal |

| Accessed Valuation |

|

|

| X - State Equalization Factor (2018)* |

2.9109 |

2.9109 |

| Equalized Assessed Value |

|

|

| X - Your Local Tax Rate |

% |

% |

| Tax Bill (before exemptions) |

|

|

| Savings |

(Before less After) |

$ |

* Your most recent Second Installment Property

Tax Bill will have the last-known tax rate.

Only two key data points are required for these comparative calculations.

- The assessed valuation BEFORE and AFTER an appeal

- Your property’s most current tax rate

(www.CookCountyPropertyInfo.com)

The valuation BEFORE an appeal is generally the same as your prior year’s valuation except in a Triennial Reassessment year. The Assessor mails your new valuation in these reassessed townships beginning in January/February through September/October. Watch your mail for a notification of the Assessor’s new valuation.

Our invoices are calculated using the last known State Equalization Factor and local tax rates because new rates may not be announced for 12 to 15 months after we complete the work.

Final calculations in the Before Appeal column should closely align with your tax bill if you do not claim any exemptions. To calculate the value of a homeowner exemption, multiply $10,000 in assessed valuation by your local tax rate and, for a senior exemption, multiply $8,000 by your local tax rate. In both cases, simply subtract your product from each column.

Take Control Of Your Tax Bill,

With Help From Property Tax Solutions.