Pappas: 2024 Chicago reassessment "worst of all possible scenarios" for homeowners

July 23, 2024 4

Will the 2024 reassessment of Chicago amount to "the worst of all possible scenarios?"

Cook County Treasurer Maria Pappas thought so in a recent interview with Fox.

"With all these commercial buildings vacant on Michigan Avenue, State Street, and LaSalle Street ... when commercial goes down, residential goes up," Pappas observed. "It's going to get worse for residents."

PTS' analysts agree with the Treasurer's analysis. Many distressed or otherwise unproductive commericial properties will receive justifiable property tax breaks under a fair application of state assessment law.

But every decision in their favor amounts to that much more of the property tax levy pie residential homeowners need to cover. It's a zero-sum game.

Anyone who owns property in Chicago is liable to face not only an increased assessment due to the Triennial but stubbornly high rates due to the struggling commercial sector.

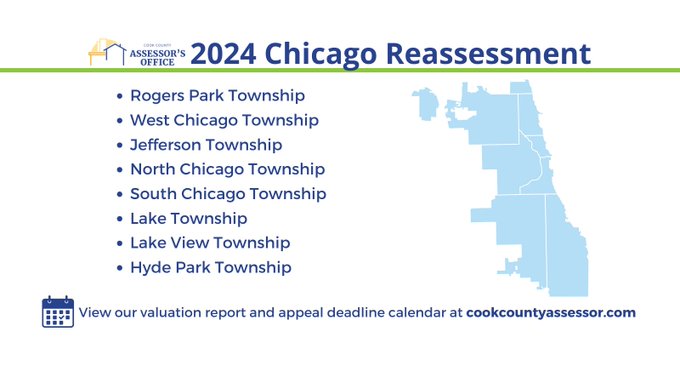

So far, each of the three Chicago Townships completed by the Assessor's Office saw increases of more than 25% on average. Such an assessment increase will cause double-digit year-over-year bill increases.

The only thing one can do as a homeowner is at least make sure your assessment is fair. Our website is a high-powered, accurate tool built with the purpose of ensuring of exactly that for any homeowner in the County.

Our software immediately downloads the latest data bulks from each of the County's 37 Townships and can immediately cross-compare assessments on behalf of any individual owner for potential savings.

If you qualify, it takes less than 5 minutes to sign-up, and TaxSave2024 unlocks a service fee discount. You only pay us contingency if we win your case.

So, please. "Check Your Savings."